Apple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980. Based out of Cupertino, the market capitalization of Apple is $2.07 trillion. Apple's product profile includes iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, while software portfolio comprises iPhone OS , OS X and watchOS operating systems, iCloud and Apple Pay.

Apple is also into digital content streaming services -- Apple Music and Apple TV+.For the quarter ended 27 June 2020, Apple earned a revenue of $59.7 billion, an increase of 11 per cent from the year-ago quarter. Other major markets for Apple include Europe, India, Middle East, Africa, China and Japan. International sales accounted for 60 percent of the quarter's revenue. Key institutional investors include Fidelity Management & Research Company, Vanguard Group, BlackRock and Berkshire Hathaway.Apple's stock was priced at $22 in its initial public offering on 12 December 1980.

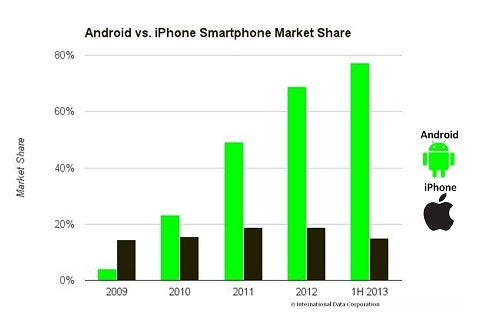

If adjusted for stock splits, the share price was about $0.10.In the global smartphone market, Apple has a 14 per cent share while in the PC segment it is at the fourth spot worldwide with 6.7 per cent market share. Read MoreApple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980. Fair Value is derived from a detailed projection of a company's future cash flows. Analysts create custom industry and company assumptions to feed income statement, balance sheet, and capital investment assumptions into a proprietary discounted cash flow modeling template.

Scenario analysis, in-depth competitive advantage analysis, and a variety of other analytical tools are used to augment the discounted cash flow process. Combining analysts' financial forecasts with the firm's economic moat helps us assess how long returns on invested capital are likely to exceed the firm's cost of capital. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Qualitative Fair Value, please click here. Apple Inc. is one of the very few companies that had successfully sensationalised the American stock market since its launch.

Headquartered in Cupertino, California this technological behemoth was co-founded by Steve Jobs, Ronal Wayne and Steve Wozniak in 1976. The company was launched with a view to innovate the field of technology and aimed to create unrivalled products for the lovers of superior experience. Its premium products include iPhones, iPads, Apple Watches, Apple cards, Macs, Apple News+, Apple Pay, and Apple TV+.

This is a bundled plan comprising four major Apple services namely, Apple Music, Apple TV+, Apple Arcade, and iCloud. Among all the advanced gadgets engineered by Apple Inc, iPhones have especially captured attention all around the world and is currently one of the highest selling smartphones. This company started its business with a single product Apple I, a computer designed and hand-built by Wozniak.

To financially support this creation, Jobs sold his Volkswagen Microbus, and Wozniak sold his calculator HP-65. The hard work and sacrifices of the founding members paid off when Apple laid hold of the biggest stock market launch in history after Ford. It kept growing from both technological and financial aspects, and by the beginning of the 21st century, Steve Jobs had become the face of Apple.

After his demise, many have criticised the company's products for their lack of innovation, but its market has consistently retained its loyal customer base. Apple briefly became the world's first $3 trillion company today based on market capitalization, which is the total value of all of the company's outstanding shares. The milestone came after Apple's stock price rose over 40% in the last year. The impressive feat, which Apple achieved when its stock price reached the $182.86 mark during intraday trading, came just over 16 months after Apple be...

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's products include iPhone, Mac, iPad, and Wearables, Home and Accessories. IPhone is the Company's line of smartphones based on its iOS operating system.

Mac is the Company's line of personal computers based on its macOS operating system. IPad is the Company's line of multi-purpose tablets based on its iPadOS operating system. Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company's wireless headphones that interact with Siri.

Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets. Apple's financial performance, including its share price, relies heavily on the sales of its products.

A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion. Using GlobalAnalyst, investors can search for stocks by region, country, industry, market capitalization and currency to uncover undervalued stocks worldwide. The resulting table displays the current market and financial metrics, including the PEG Ratio. The PEG Ratio is the PE ratio divided by the three-year compound earnings growth rate, and smaller PEG Ratios typically indicate undervalued companies.

MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. From a 52-week low of $116.21, Apple's share price reached a high of $182.94 on Jan. 4. The company's market capitalization also fluctuated during this period. When the markets closed on Jan. 28, Apple's share price was $170.33, giving the company a current market capitalization of about $2.78 trillion.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.97% per year. These returns cover a period from January 1, 1988 through February 28, 2022. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Just as Apple's market capitalization hits the $3 trillion milestone, its share price as a percentage of the Nasdaq 100 index's (.NDX) value is bumping up against a key technical level. In recent prior times, the stock price has risen above such a level and then subsequently declined. IPad is the Company's line of multi-purpose tablets based on its iPadOS... Market cap does have its drawbacks as an evaluation method, however. For starters, market cap changes frequently, and it's closely tied to the company's current share price. It doesn't take into account any of the direct financial metrics of the company, such as earnings per share, growth rate or book value.

Analysts and global investors are keeping a close watch on several areas in the company including upcoming holiday iPhone sales, AR and VR headsets, cash flows, stock buybacks among others. Going into 2022, Apple is expected to remain a preferred mega-cap US stock to hold in one's portfolio and a top stock pick for 2022. Even if there are dips and corrections in the stock in the short to medium term, it may be used as an opportunity to add the shares in the long term portfolio.

The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. Apple shareholders must be extremely happy with the company's performance in the past 12 months. The stock price is up 111% since the end of 2018, not to mention the US$3 (£2.31) per share that the company has paid in dividends over the period. While Apple's full-year 2019 results will not be released until later in January, it generated operating income of US$15.6 billion in the third quarter of the year.

That translates to about US$60 billion a year, or about the same size as the economy of Luxembourg. A pandemic-era surge in tech stocks has driven the major US tech companies to new highs, pulling US stock markets with them. He added that the company "seems to be in good position to work through supply-chain issues" which have been affecting tech companies large and small.

Issuing investors 19 additional shares for every share held would, based on today's closing price, lower Alphabet's stock price from $2,700 per share to less than $150. The shares rose more than 8% on the news on Feb. 2 when they approached $3,000. Stock buybacks reduce the number of total shares available for purchase. That makes each remaining share more valuable and improves the underlying fundamentals of the company in equations that large investors and automated trading systems use to pick stocks.

Apple Inc stock price live 164.29, this page displays NASDAQ stock exchange data. View the AAPL premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Apple Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the AAPL quote.

How Much Is A Apple Share Worth This makes Apple the world's most valuable company by market cap according to our data. The market capitalization, commonly called market cap, is the total market value of a publicly traded company's outstanding shares and is commonly used to mesure how much a company is worth. Large companies beat collective market expectations of their earnings to positively influence their market capitalization.

That they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices is no accident. As a result, the Securities and Exchange Commission intensely scrutinizes earnings management. Apple first sold shares to the public on Dec. 12, 1980, at $22 per share. The stock has split four times -- three times at 2-for-1, and one split at 7-for-1. This means you would have received two shares for every one share, or seven shares in that one case. The waystock splitswork is that you receive more shares but the stock price is cut proportionally, so the value of your investment stays the same.

Apple on Monday became the first company to hit a market capitalization of $3 trillion — more than nine times what the company was worth when founder Steve Jobs died in 2011. Recently Apple has paid out, on average, around 14.57% of net profits as dividends. That has enabled analysts to estimate a "forward annual dividend yield" of 0.57% of the current stock value. This means that over a year, based on recent payouts , Apple shareholders could enjoy a 0.57% return on their shares, in the form of dividend payments. In Apple's case, that would currently equate to about $0.865 per share. This money was indeed transferred to shareholders, but with two caveats.

First, those who sold their shares did so because they left the company or at least reduced their stakeholding – in other words, Apple is rewarding its least loyal investors by enabling them to cash out at a high price. That is a strange way of returning money to investors since it discriminates against those who are not selling. Returning money via the buyback route has the added bonus in some jurisdictions, such as the US and Switzerland, of being more tax-favourable for these investors compared to the more regular dividend route.

To see how long this pattern can hold, we need to assess whether Apple's performance is sustainable. When you compare the last four quarters' operating income – from fourth quarter 2018 to third quarter 2019 – with the previous four, you're looking at a fall of 10%. Over the same period, the company's revenues dropped by more than 5%.

The main culprits were falling sales of iPhones, in a world saturated with smartphones, and a big tailing off in China, which is the company's third-largest market. Growth businesses such as the Apple Watch and the app store were not enough to offset the decline. Apple Inc. is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications,... Apple last month became the first company to reach a market capitalization of $3 trillion.

But with a pullback in Apple stock after hitting that milestone, many investors are wondering if AAPL stock is a buy right now. On the first day of trading in 2022, the Silicon Valley company's shares hit an intraday record high of $182.88, putting Apple's market value just above $3 trillion. The stock ended the session up 2.5% at $182.01, with Apple's market capitalization at $2.99 trillion. Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure.

Apple's market cap varies from moment to moment based primarily on its share price. Although an increase in outstanding shares could also increase its market cap, that type of change occurs far less frequently than a change in share price, which can occur in less than one second. By way of comparison, the price-earnings ratio, which is another popular valuation method, is also closely tied to a company's market share price.